TPG Specialty Lending, Inc. Sends Letter to TICC Board of Directors Calling Recent Actions Wholly Unacceptable and Affirming Commitment to Deliver Value to TICC Stockholders

Mar 17, 2016

|

TSLX Urges TICC Stockholders to Elect Independent Candidate to TICC Board and Adopt Proposal to Terminate the Investment Advisory Agreement Between TICC and External Manager

TSLX is Encouraged by Investor Focus on BDC Sector and Confident TICC Stockholders will Force Meaningful Change

TSLX Remains Committed to its Clear, Compelling Alternatives to Generate Value for TICC Stockholders

TICC’s Recent Proposals Fail to Meaningfully Address Fundamental Failures, Including Continued Poor Performance and Troubling Governance Practices

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20160317006148/en/

(Graphic: Business Wire)

In its letter to the TICC Board, TSLX also expressed its disappointment that TICC’s recently announced “fee waiver” and its appointment of a new Chairman of the Board are empty gestures that fail to effect real change for TICC investors and further undermine corporate governance at TICC. TSLX has identified clear, compelling alternatives to generate value for TICC stockholders that remain unaddressed by the TICC Board.

A copy of the letter follows:

Board of Directors

Dear Members of the Board:

We are writing to express our disappointment in the recent events that

further undermine corporate governance at

We were surprised to hear you say on your fourth quarter earnings call

held on

As we have moved through this process since September of last year, it has become apparent through your actions that you remain solely focused on saving your positions on the Board and as the external manager rather than fulfilling your duty to TICC investors. We have outlined clear and powerful measures that TICC could implement to create tremendous value and we remain committed to effecting change.

We respond to the announcements you made last week in more detail below.

However, the points we lay out have already been understood by our

fellow TICC stockholders as total return for TICC is down 3.9% since

your announcement on

Put simply, the “fee waiver” and appointment of a new Chairman of the

Board are empty gestures and a transparent attempt to escape the

resounding defeat you experienced at the special meeting of TICC

stockholders on

-

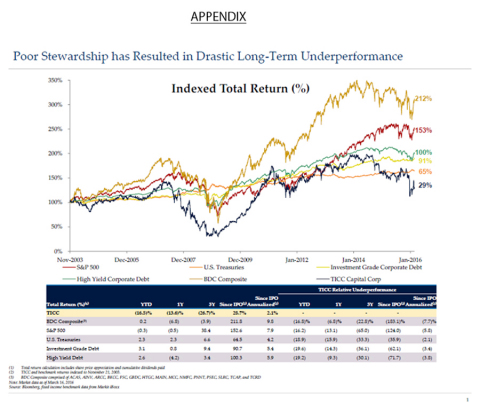

Reduction in Fees – After years of terrible performance, including

underperforming the BDC Composite by 183.1 percentage points since

your IPO on a total returns basis, a whopping 7.7 percentage points

per year of under-performance, the only appropriate response from the

Board would have been to terminate the management contract with the

external manager. Again, TICC’s net total return for investors was

approximately 2% per year less than if you had invested in risk-free

U.S. treasuries. As we have said time and again, our issues with TICC

are broad and systemic. While important, a simplistic focus on fees

distorts the core problems at TICC to easily-manipulated and

misleading headline figures. Any fees paid to the external manager

are too high given TICC’s massive and consistent underperformance.

Rewarding the same management team through marginally reduced fees does not address the core problem of poor performance. A change in management was passionately advocated by the Board and the current management team as they negotiated the now failed transaction that would have enriched management at the expense of your existing stockholders. Simply put, after 14 years of underperformance across all time periods, the answer shouldn’t be a reduction in continued compensation. The answer, as the Board had previously advocated, is real change— change in management and the external manager, and a change in investment strategy.

We find Mr. Novak’s characterization of the reduced fee structure as “best in class” laughable. Fees and compensation should be a function of management’s ability to add value and drive return on equity (“ROE”), not metrics to be viewed in isolation and certainly not ones to be determined against a barely comparable group of other BDCs (particularly a group that conveniently ignores the underlying nature of the assets they own).

In our review of BDC peers, we believe TICC has failed to truly recognize the unique nature of its own portfolio of broadly syndicated securities versus bespoke, directly originated transactions. In our view the most appropriate compensation structure for TICC’s portfolio is that ofAmerican Capital Senior Floating, Ltd. (NASDAQ: ACSF). The composition of ACSF’s portfolio is nearly identical to TICC’s with 84% senior secured broadly syndicated debt and 16% collateralized loan obligation (“CLO”) equity; TICC has a portfolio composed of 71% senior secured broadly syndicated debt and 27% CLO equity. Meanwhile, ACSF charges 80 basis points of management fee on assets and no incentive fee. TICC’s new fee structure that includes a 1.5% base management fee and a 20% incentive fee continues to look rich indeed when assessed against a comparable collateral mix.

In other words, TICC’s new fee structure is approximately 265% higher than applying the comparable fee structure from ACSF against the TICC portfolio, including the incentive fee.

It should also be noted that ACSF trades at approximately 78% of book value, even with its lower fee structure. The sobering reality in our view is that any notion of TICC shares trading at Net Asset Value without implementing more significant changes than those announced is a distant reality.

- New Chairman – Appointing Mr. Novak as the “independent” Chairman of the Board is not only misdirected but highly concerning. Mr. Novak led the Special Committee during the flawed and failed transaction in 2015. His supposed leadership resulted in the reappointment of the same underperforming external manager for 12 consecutive years and he led the Special Committee during a process in which a federal judge found TICC to have misled stockholders and to have likely violated federal securities laws. We do not see how Mr. Novak, a Board member for over 13 years, can continue to be viewed as independent or be in any position to positively effect change for TICC stockholders given his track record of weak corporate governance on behalf of TICC stockholders.

On

We are compelled to move forward with this campaign for change as TICC has not addressed its fundamental failures. Our issues with TICC extend beyond merely fees. TICC’s value destructive capital allocation strategy has continually eroded Net Asset Value (“NAV”) and destroyed stockholder value, and yet the Board continues to prioritize wealth creation for the underperforming external manager.

Over the last quarter alone, TICC has seen a NAV per share decrease of

18.1%, which is almost as astonishing as the 25.6% NAV per share

decrease over the past two quarters. TICC’s stock trades at 73% of pro

forma NAV including the impact of the early stock buybacks in 2016.

Although we applaud management’s willingness to repurchase shares during

the fourth quarter of 2015 and during 2016, it is not lost on us nor

on other stockholders that management has refused to commit to

continuing this strategy. The idea that you are not continuing to

buy back stock at a 27% discount to NAV is unacceptable. Our estimate is

that the 2016 repurchases have added approximately

The proposals that have been put in motion with your

Your actions lead us to believe that TICC’s external manager continues to be prioritized above TICC stockholders.

As you know, we have nominated Mr.

Under the Investment Company Act of 1940, as amended, stockholders have the power to terminate the external manager at no cost to stockholders. The burden of TICC’s failed external manager must finally be lifted from stockholders. Severing ties at no cost for stockholders will enable a fresh view on how to produce change and guide the Company away from an investment strategy that has impaired TICC’s financial future.

Mr. Millet’s more than 30 years of proven industry expertise across the

financial sector, particularly in credit markets, coupled with his

proven leadership as a director, make him the ideal candidate to effect

change at TICC. He has led companies across the financial services

sector in senior positions, including in his current role as CEO of

A contentious proxy fight is not our preferred course of action. As we have said before, we urge you to immediately seat Mr. Millet on the Board and reconstitute the Board with independent, highly qualified individuals willing to act aggressively in the interest of TICC stockholders. We also urge you to immediately terminate the existing investment advisory agreement with the external manager.

We hope our efforts to bring the issues that have plagued TICC’s performance to light will lead other TICC stockholders and members of the broader investment community to share our view. Given what we have seen unfold at other BDCs this year, we are confident TICC will not go overlooked.

We are also troubled by TICC’s lack of transparency on its annual

stockholder meeting date. In this regard, we note with concern the

comment made by

We expect the Board will schedule the 2016 annual meeting of stockholders within the same time frame—early June—as it has in the past versus trying to maneuver for a date that will improve their chances of resisting stockholder nominees and proposals.

We believe termination of the existing investment advisory agreement and reconstitution of the Board will be the catalysts needed to finally unlock stockholder value, resulting in the potential for significant growth in TICC’s stock. We remain committed to work for this needed change.

It is time for stockholders to take action. The time for change is now.

| Very truly yours, | |

|

TPG SPECIALTY LENDING, INC. |

|

| By: ___________________________ | |

| Joshua E. Easterly | |

| Chairman and Co-Chief Executive Officer | |

| By: ___________________________ | |

| Michael Fishman | |

| Co-Chief Executive Officer | |

About

Forward-Looking Statements

Information set forth herein includes forward-looking statements. These

forward-looking statements include, but are not limited to, statements

regarding TSLX’s proposed business combination transaction with

Such forward-looking statements are inherently uncertain, and

stockholders and other potential investors must recognize that actual

results may differ materially from TSLX’s expectations as a result of a

variety of factors including, without limitation, those discussed below.

Such forward-looking statements are based upon management’s current

expectations and include known and unknown risks, uncertainties and

other factors, many of which TSLX is unable to predict or control, that

may cause TSLX’s plans with respect to TICC, actual results or

performance to differ materially from any plans, future results or

performance expressed or implied by such forward-looking statements.

These statements involve risks, uncertainties and other factors

discussed below and detailed from time to time in TSLX’s filings with

the

Risks and uncertainties related to the proposed transaction include, among others, uncertainty as to whether TSLX will further pursue, enter into or consummate the transaction on the terms set forth in the proposal or on other terms, potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction, uncertainties as to the timing of the transaction, adverse effects on TSLX’s stock price resulting from the announcement or consummation of the transaction or any failure to complete the transaction, competitive responses to the announcement or consummation of the transaction, the risk that regulatory or other approvals and any financing required in connection with the consummation of the transaction are not obtained or are obtained subject to terms and conditions that are not anticipated, costs and difficulties related to the integration of TICC’s businesses and operations with TSLX’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from the transaction, unexpected costs, liabilities, charges or expenses resulting from the transaction, litigation relating to the transaction, the inability to retain key personnel, and any changes in general economic and/or industry specific conditions.

In addition to these factors, other factors that may affect TSLX’s plans, results or stock price are set forth in TSLX’s Annual Report on Form 10-K and in its reports on Forms 10-Q and 8-K.

Many of these factors are beyond TSLX’s control. TSLX cautions investors that any forward-looking statements made by TSLX are not guarantees of future performance. TSLX disclaims any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments.

Third Party-Sourced Statements and Information

Certain statements and information included herein have been sourced from third parties. TSLX does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein. All information in this communication regarding TICC, including its businesses, operations and financial results, was obtained from public sources. While TSLX has no knowledge that any such information is inaccurate or incomplete, TSLX has not verified any of that information. TSLX reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. TSLX disclaims any obligation to update the data, information or opinions contained herein.

Proxy Solicitation Information

The information set forth herein is provided for informational purposes

only and does not constitute an offer to purchase or the solicitation of

an offer to sell any securities. TSLX intends to file a preliminary

proxy statement with the

TSLX STRONGLY ADVISES ALL STOCKHOLDERS OF TICC TO READ THE TSLX PROXY STATEMENT AND ITS OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH TSLX PROXY MATERIALS WILL BECOME AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV AND ON TSLX’S WEBSITE AT HTTP://WWW.TPGSPECIALTYLENDING.COM. IN ADDITION, TSLX WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO TSLX’S PROXY SOLICITOR AT TPG@MACKENZIEPARTNERS.COM.

The participants in the solicitation are TSLX and

Security holders may obtain information regarding the names,

affiliations and interests of TSLX’s directors and executive officers in

TSLX’s Annual Report on Form 10-K for the year ended

1 As of the date hereof, TSLX directly beneficially owned 1,633,660 shares of common stock of TICC

2 BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC,

GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD. Market

data as of

View source version on businesswire.com: http://www.businesswire.com/news/home/20160317006148/en/

Source:

Investors

TPG Specialty Lending

Lucy Lu, 212-601-4753

llu@tpg.com

or

Media

Luke

Barrett, 212-601-4752

lbarrett@tpg.com

or

Abernathy

MacGregor

Tom Johnson or Pat Tucker

212-371-5999

tbj@abmac.com

/ pct@abmac.com