TPG Specialty Lending, Inc. Sends Letter to Independent Directors of TICC Capital Corp. Seeking an Objective Evaluation of TICC’s Recent Financial Performance and Actions

Aug 29, 2016

|

TSLX Highlights Discrepancies in TICC’s Public Statements Compared to the Reality of its Investment Portfolio and Recently Reported Financial Results

Calls for TICC’s Independent Directors to Resign if Directors Are Unwilling or Unable to Fulfill Their Duties to Stockholders

TSLX Poses Six Important Questions on Behalf of All Stockholders to TICC’s Board Regarding the State of Stockholders’ Investment in TICC

TSLX Encourages TICC Stockholders to Vote the GOLD Proxy Card

to Terminate TICC’s External Adviser’s Advisory Contract and Elect T.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20160829005496/en/

Appendix A -

TSLX strongly encourages stockholders to sign and return the GOLD proxy card today. TSLX urges stockholders to ignore TICC’s self-serving actions and discard any WHITE proxy cards. Even if a WHITE card has been submitted, stockholders can still change their vote, simply by returning the GOLD proxy card now. Voting instructions and TSLX’s proxy materials are also available through the SEC’s website and at www.changeTICCnow.com.

A copy of the letter follows:

| Mr. Steven P. Novak |

| Mr. G. Peter O’Brien |

| Ms. Tonia L. Pankopf |

| TICC Capital Corp. |

| 8 Sound Shore Drive, Suite 255 |

| Greenwich, CT 06830 |

Dear Independent Directors,

We are writing as the largest single stockholder of

Like many others in the investment community, we continue to be frustrated by the actions taken by TICC’s external adviser to avoid a constructive dialogue regarding the Company’s operations and results. A case in point is TICC’s refusal to issue its quarterly report on Form 10-Q prior to conducting its earnings call with stockholders. Not only does this demonstrate a profound lack of respect for the views of TICC’s stockholders and equity research analysts, it prevents any meaningful public discourse regarding TICC’s performance, strategy and execution, thereby enabling poor performance to continue unchecked. As a result, we feel obligated to raise publicly several important questions to TICC’s Board on behalf of all stockholders regarding the state of their investment:

|

1. |

What drove the change in the level yield at which TICC recognized GAAP revenue from CLO equity investments in the second quarter of 2016 – the quarter immediately preceding the annual meeting at which stockholders will vote on a proposal to terminate the external adviser’s contract? |

|||||

|

Based on the schedule of investments included in TICC’s Form 10-Q filing, it appears that substantially all of the reported increase in investment income per share resulted from a change in the level yield assumptions that TICC utilizes to recognize GAAP revenue from its Collateralized Loan Obligation (“CLO”) equity investments.1 During the second quarter of 2016, the level yield at which TICC recognized revenue from CLO equity investments increased by approximately 50.6%, to 12.8% from 8.5% in the preceding quarter.2 This increase included an approximately 24.8% increase in the cost-weighted average level yield applied to existing positions compared to the yield used for the three months prior. |

||||||

|

We note that, by contrast, the key metrics reflecting the underlying strength of your CLO equity investments appear to have deteriorated. For example, cash-on-cash distributions declined by approximately 14% quarter-over-quarter and 27% year-over-year while junior over-collateralization cushions, which measure the health of CLOs and can be used as a means to predict possible future cash distributions to equity holders, declined by approximately 5% quarter-over-quarter and 17% year-over-year.3 Although GAAP permits management to revisit level yield assumptions from time to time, as a stockholder, we want to understand the underlying rationale that drove TICC to undertake discretionary changes to these assumptions in the second quarter of 2016, at a time when the external adviser’s performance is being questioned by numerous independent analysts and advisors and the termination of its contract is up for a vote of stockholders. |

||||||

|

2. |

Why was the $0.14 per share in realized losses not highlighted to stockholders? |

|||||

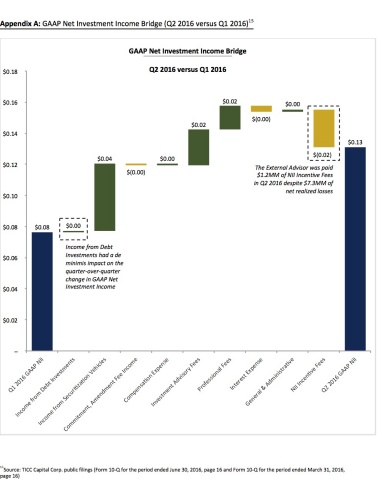

| Although TICC reported $0.13 per share in GAAP net investment income (“NII”) for the second quarter of 2016, the Company’s statement of operations show that this was driven principally by reduced expenses and the change in level yield at which TICC recognized revenue on its CLO equity investments discussed above, neither of which have much to do with the Company’s investment strategy or ability to deliver future earnings.4 | ||||||

|

Even more important to stockholders, we believe the Company’s second quarter earnings release glosses over the magnitude of TICC’s net realized losses. Put simply, the $0.13 per share in GAAP NII that TICC reported in Q2 2016 is more than offset by $0.14 per share in losses realized during the quarter.5 That means the economic value within the control of management (excluding unrealized gains) that TICC delivered to stockholders in the most recent quarter was NEGATIVE. It is not lost on stockholders that realized losses represent a permanent impairment of stockholder capital. |

||||||

|

3. |

Why did TICC’s external adviser collect an NII incentive fee in the second quarter of this year when the Company reported realized losses of $7.3 million? How can it justify any fee at all? |

|||||

|

The Company paid its external adviser an incentive fee of approximately $1.2 million6 during the most recent quarter, at the same time that the Company reported realized losses of $7.3 million. We were surprised to learn that this was a quid pro quo for the so-called “best-in-class” fee waiver that was trumpeted by the Board earlier this year as a stockholder-friendly measure. In connection with the fee waiver, the Board agreed that the look-back reference date for the payment of NII incentive fees would be reset to April 1, 2016. As a result, any losses suffered by TICC’s portfolio prior to April 1, 2016, whether realized or unrealized, will not affect the adviser’s ability to reap NII incentive fees going forward. Using the term “waiver” to describe this is itself thus a misnomer. There was no unilateral concession by the external adviser; instead the Board agreed to wipe clean the slate of accumulated losses. This certainly cannot be in the best interest of stockholders, given the external adviser’s past performance. Through this reset, the external adviser gets to start over, despite the decade of underperformance delivered prior to the resetting of the threshold. As a result, TICC could realize losses of up to approximately $155.3 million7 and still be in a position that it might have to pay incentive fees, this most recently completed quarter being a case in point. We suspect that long-suffering TICC stockholders wish they could similarly wipe clean their losses in TICC’s shares. |

||||||

|

4. |

Has the Company actually implemented a new investment strategy? |

|||||

| In a November 18, 2015 public statement, the Company announced the sale of certain syndicated corporate loans and stated that “a rotation out of lower-yielding corporate loan assets held within a leveraged credit facility into higher-yielding loans held on a less levered basis represents a compelling strategy,” and on March 10, 2016, TICC CEO Jonathan Cohen announced on the fourth quarter of 2015 earnings call that management was “committed to rotating out of CLO equity over time.” Your actions, however, appear to contradict your stated intent to implement a new investment strategy. | ||||||

|

Instead of exiting CLO equity investments, however, TICC reported a meaningful increase in CLO equity investments during the second quarter of 2016, with $37.9 million of CLO equity purchased during the quarter, which represented 51.6% of the second quarter’s new investment activity.8 CLO equity investments now represent approximately 32% of TICC’s total investment portfolio at fair value, a meaningful increase from the first quarter of 2016.9 |

||||||

|

5. |

Why did TICC state that its new investment strategy is “already yielding results”? |

|||||

|

In its August 18, 2016 public statement, TICC claimed that “[t]he Company has revised its investment strategy, which is already yielding results.” Setting aside the increase in CLO equity investments, which is certainly a part of the old strategy, we must note that the Company’s financial statements show that interest income from debt investments (where the impact of new middle market originations would be presented in your income statement) actually decreased to $8.7 million in the second quarter of 2016 versus $8.9 million in the first quarter of 2016,10 resulting in virtually no change in these debt investments’ contribution to total investment income on a per share basis.11 Does a quarter-over-quarter decrease in income from debt investments really equate to “yielding results”? How does TICC explain the discrepancy between how the Board describes its investment strategy and the reality of the performance of its portfolio? |

||||||

|

6. |

Shouldn’t stockholders judge the performance of the Company for as long as management has been in charge and not from the bottom of the market? |

|||||

|

We agree with TICC’s August 18, 2016 public statement that the Company’s performance should be “evaluated over a longer period.” On this point the facts are clear: TICC has underperformed nearly every significant benchmark since its IPO in 2003. |

||||||

|

Since 2003, the Company has delivered underperformance of NEGATIVE 182.9% as compared to the BDC Composite.12 TICC’s Board and external advisor have been the stewards of an investment strategy that has resulted in a 52% decline in net asset value (“NAV”) per share since 2004.13 How can the Company continue to defend this drastic level of underperformance? |

||||||

| You have argued that stockholders should look only at a single period of time—since 2009. However, we find it misleading to only look at the Company’s results since 2009, because your results since that point essentially reflect a recovery from your severe underperformance relative to peers prior to and during the financial crisis.14 We note your attempt to cherry-pick results didn’t persuade ISS or the other proxy advisors. In fact, TICC has delivered year-to-date returns of 14.7% in 2016, compared to 17.5% for the BDC Composite, demonstrating that even TICC’s recent performance has been subpar. | ||||||

As TICC’s largest single stockholder, we continue to reiterate our commitment to enhancing the value of stockholders’ investment in the Company. The above questions are critical to helping us and our fellow stockholders understand the leadership decisions being made by you, TICC’s Board, and management. Stockholders deserve real answers.

We genuinely hope that the TICC board will look critically at its strategies, capital allocation policies and corresponding performance. Independent experts have overwhelmingly expressed concern with TICC’s actions and underperformance, and have urged stockholders to support our campaign for change. All three leading proxy advisors have recommended that stockholders support our efforts. Even if you ignore the facts outlined above, consider what well-respected independent third parties have said:

-

“As a result of the current advisor's investment strategy, TICC has

delivered negative [Total Shareholder Return] and underperformed peers

and the index over the past five years . . . As such, terminating the

current advisor appears to be in the best interest of TICC

shareholders.”

– ISS proxy advisory report,

- “[W]e believe that voting FOR the [TSLX] nominee and voting FOR the termination of the investment advisory agreement is in the best interest of the Company and its shareholders. In arriving at that conclusion, we have considered the following factors: 1. Our belief that the [e]xisting [a]dviser’s investment strategy did not work on the benefit of the Company and its stockholders. 2. We believe that [TSLX] would work on offering an opportunity to the Company to be under a reputable external adviser with a reasonable amount of investment adviser fees to protect and maximize stockholder value.”

– Egan-Jones proxy advisory report,

- “The overriding fact facing shareholders is that the board failed to take action while overseeing five years of TICC underperformance, which by itself signals that change is needed at the board level. Moreover, the long tenure of this board, with each of its five members having served for 13 years as directors, suggests that the company should welcome fresh perspectives to the board. As such, there seems to be a compelling case that change is warranted at this time.

– ISS proxy advisory report,

- “[W]e consider the appointment of Mr. Millet affords important benefits above and beyond his financial expertise, most notably with respect to his ability to immediately inject a fresh, outside perspective and a willingness to thoughtfully evaluate TICC's present circumstances . . . [W]e consider the election of Mr. Millet represents a more favorable outcome for unaffiliated investors by a wide margin.”

–

We continue to be very disappointed in your repeated and continued assertions that we have not articulated a plan and that terminating the existing investment advisory agreement could result in TICC being left with no investment adviser, no management team and no operational infrastructure. As ISS correctly pointed out, this risk “appears to be utterly within the board's control … literally by identifying a new advisor.” In ISS’s words, “[t]o the extent shareholders have a risk here, … it would appear the root cause of the risk would be the current director's unwillingness to fulfil [sic] their responsibilities to shareholders by taking any action at all.”

We find it wholly inappropriate for you, the independent directors, to argue that your stockholders should vote against change because that change may present the risk that TICC’s independent directors will fail to act in accordance with their fiduciary duties. If you are saying that you are unable or unwilling to fulfill your duties to stockholders, we respectfully request that you resign.

As a long-term participant in the BDC space, we have an interest in seeing that TICC and other BDCs employ best-in-class corporate governance principles, provide stockholders with real transparency, and deliver strong results for stockholders, including through sound capital allocation and active management. Therefore, we hope that our efforts to date, on behalf of all TICC stockholders, will lead you to genuinely re-examine the Company’s practices so that stockholders have the opportunity to benefit from the changes they need and deserve.

| Respectfully, |

| TPG SPECIALTY LENDING, INC. |

| Joshua Easterly |

| Chairman and Co-Chief Executive Officer |

| Michael Fishman |

| Co-Chief Executive Officer |

Appendix A:

See multimedia carousel for chart.

Appendix B: TICC CLO Equity Portfolio – Performance Statistics16,17

| CLO Equity Position |

Principal18 |

Cost18 | Fair Value18 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

%∆ |

%∆ |

||||||||||

| ACAS CLO 2012- 1, Ltd. | $6,000,000 | $2,197,157 | $2,460,000 | |||||||||||||||||

|

Cash-on-Cash Distribution19 |

4.7% | 3.7% | 4.0% | 3.3% | 2.8% | (15.1%) | (40.1%) | |||||||||||||

|

Junior Overcollateralization Cushion20 |

5.6% | 5.6% | 5.6% | 4.5% | 4.0% | (10.6%) | (27.6%) | |||||||||||||

| ALM X, Ltd. | $3,801,000 | $2,587,735 | $2,593,317 | |||||||||||||||||

| Cash-on-Cash Distribution | 6.9% | 7.6% | 7.2% | 6.9% | 6.4% | (8.5%) | (8.1%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.1% | 3.8% | 3.8% | 3.3% | 3.3% | (1.7%) | (20.6%) | |||||||||||||

| ALM XII, Ltd. | $2,825,000 | $2,451,703 | $2,401,250 | |||||||||||||||||

| Cash-on-Cash Distribution | n/a | 5.4% | 5.5% | 6.4% | 5.6% | (12.6%) | n/a | |||||||||||||

| Junior Overcollateralization Cushion | 4.2% | 4.2% | 4.3% | 4.3% | 4.0% | (6.9%) | (4.1%) | |||||||||||||

| AMMC CLO XI, Ltd. | $6,000,000 | $3,340,013 | $2,640,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 3.9% | 4.1% | 4.0% | 3.9% | 3.4% | (13.6%) | (13.9%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.2% | 3.9% | 3.9% | 3.7% | 4.5% | 21.1% | 7.2% | |||||||||||||

| AMMC CLO XII, Ltd. | $12,921,429 | $7,872,678 | $6,202,286 | |||||||||||||||||

| Cash-on-Cash Distribution | 5.2% | 5.2% | 5.0% | 6.5% | 2.8% | (56.9%) | (46.0%) | |||||||||||||

| Junior Overcollateralization Cushion | 5.1% | 4.5% | 4.6% | 4.5% | 4.5% | 1.5% | (10.5%) | |||||||||||||

| Ares XXV CLO Ltd. | $15,500,000 | $10,294,819 | $6,820,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 4.1% | 3.8% | 3.4% | 3.6% | 2.8% | (20.9%) | (30.7%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.1% | 3.6% | 3.5% | 3.3% | 2.7% | (19.0%) | (34.6%) | |||||||||||||

| Ares XXVI CLO Ltd. | $10,500,000 | $6,708,840 | $4,258,249 | |||||||||||||||||

| Cash-on-Cash Distribution | 5.2% | 5.0% | 4.4% | 4.7% | 3.8% | (18.5%) | (25.9%) | |||||||||||||

| Junior Overcollateralization Cushion | 3.9% | 3.5% | 3.4% | 3.0% | 2.5% | (18.6%) | (37.0%) | |||||||||||||

| Ares XXIX CLO Ltd. | $12,750,000 | $9,409,679 | $6,240,823 | |||||||||||||||||

| Cash-on-Cash Distribution | 5.8% | 4.9% | 4.6% | 4.5% | 3.9% | (13.7%) | (31.8%) | |||||||||||||

| Junior Overcollateralization Cushion | 3.7% | 3.3% | 3.2% | 3.0% | 2.4% | (21.5%) | (36.2%) | |||||||||||||

| Benefit Street Partners CLO II, Ltd. | $23,450,000 | $20,967,353 | $14,299,564 | |||||||||||||||||

| Cash-on-Cash Distribution | 5.6% | 7.5% | 6.4% | 6.4% | 5.1% | (19.9%) | (9.0%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.4% | 4.5% | 4.6% | 4.5% | 3.3% | (27.0%) | (26.2%) | |||||||||||||

| Carlyle GMS CLO 2013- 2, Ltd. | $10,125,000 | $7,030,284 | $5,886,917 | |||||||||||||||||

| Cash-on-Cash Distribution | 6.1% | 7.0% | 5.6% | 6.4% | 5.5% | (14.3%) | (9.5%) | |||||||||||||

| Junior Overcollateralization Cushion | 5.1% | 5.1% | 5.1% | 4.7% | 4.7% | – | (6.7%) | |||||||||||||

| Carlyle GMS CLO 2014- 4, Ltd. | $25,784,000 | $18,404,728 | $18,003,917 | |||||||||||||||||

| Cash-on-Cash Distribution | 11.7% | 5.6% | 4.6% | 5.2% | 4.2% | (18.1%) | (64.0%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.4% | 4.5% | 4.6% | 4.3% | 4.5% | 4.7% | 3.3% | |||||||||||||

| Catamaran CLO 2012- 1 Ltd. | $23,000,000 | $12,971,150 | $4,140,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 4.5% | 4.8% | 4.6% | 3.8% | 4.0% | 4.7% | (12.8%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.8% | 4.8% | 3.5% | 2.4% | 2.7% | 13.3% | (44.1%) | |||||||||||||

| Catamaran CLO 2013- 1 Ltd. | $14,700,000 | $9,638,879 | $7,497,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 6.2% | 5.9% | 5.7% | 5.3% | 5.4% | 0.7% | (13.4%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.9% | 4.9% | 3.8% | 4.6% | 4.7% | 1.2% | (4.1%) | |||||||||||||

| Cedar Funding II CLO, Ltd. | $18,750,000 | $14,070,499 | $12,187,500 | |||||||||||||||||

| Cash-on-Cash Distribution | 4.3% | 3.3% | 3.7% | 3.5% | 3.3% | (4.8%) | (22.9%) | |||||||||||||

| Junior Overcollateralization Cushion | 5.2% | 5.2% | 4.9% | 4.4% | 4.5% | 2.0% | (14.1%) | |||||||||||||

| CIFC Funding 2012- 1, Ltd. | $12,750,000 | $7,303,328 | $4,717,500 | |||||||||||||||||

| Cash-on-Cash Distribution | 6.3% | 5.4% | 5.2% | 5.1% | 5.2% | 1.2% | (18.2%) | |||||||||||||

| Junior Overcollateralization Cushion | 5.2% | 5.2% | 4.8% | 4.8% | 4.6% | (4.9%) | (11.8%) | |||||||||||||

| FINN Square CLO, Ltd. | $5,500,000 | $2,206,069 | $2,310,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 5.2% | 4.4% | 4.9% | 4.1% | 4.1% | (0.0%) | (19.8%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.6% | 4.7% | 4.7% | 3.8% | 2.9% | (23.8%) | (37.3%) | |||||||||||||

| GoldenTree Loan Opportunities VII | $4,670,000 | $2,977,127 | $3,128,900 | |||||||||||||||||

| Cash-on-Cash Distribution | 6.7% | 6.3% | 6.5% | 6.4% | 5.4% | (15.9%) | (19.8%) | |||||||||||||

| Junior Overcollateralization Cushion | 5.1% | 4.9% | 4.7% | 3.7% | 4.4% | 18.2% | (14.8%) | |||||||||||||

| Halcyon Loan Advisors Funding 2014- 2 | $8,000,000 | $5,598,450 | $3,860,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 7.0% | 6.1% | 6.4% | 6.6% | 5.6% | (14.8%) | (20.1%) | |||||||||||||

| Junior Overcollateralization Cushion | 5.1% | 5.4% | 4.6% | 3.5% | 2.5% | (29.1%) | (51.6%) | |||||||||||||

| Hull Street CLO Ltd. | $5,000,000 | $3,592,246 | $2,100,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 8.5% | 7.7% | 6.8% | 6.2% | 5.0% | (19.2%) | (40.7%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.6% | 4.6% | 3.9% | 2.4% | 2.5% | 1.6% | (46.6%) | |||||||||||||

| CLO Equity Position |

Principal21 |

Cost4 | Fair Value4 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

%∆ |

%∆ |

||||||||||

| Ivy Hill Middle Market Credit Fund VII | $14,000,000 | $11,896,222 | $10,173,989 | |||||||||||||||||

| Cash-on-Cash Distribution | 5.1% | 5.1% | 4.8% | 5.3% | 4.8% | (8.4%) | (4.8%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.9% | 5.0% | 5.1% | 5.0% | 5.1% | 1.5% | 4.3% | |||||||||||||

| Jamestown CLO V Ltd. | $8,000,000 | $5,476,339 | $2,880,000 | |||||||||||||||||

| Cash-on-Cash Distribution | n/a | 11.9% | 4.8% | 4.9% | 4.2% | (15.5%) | n/a | |||||||||||||

| Junior Overcollateralization Cushion | 4.0% | 1.8% | 1.6% | 1.5% | 1.2% | (22.8%) | (70.5%) | |||||||||||||

| KVK CLO 2013- 2, Ltd. | $5,000,000 | $1,834,437 | $1,950,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 5.3% | 5.6% | 5.0% | 5.5% | 4.3% | (21.1%) | (18.4%) | |||||||||||||

| Junior Overcollateralization Cushion | 3.8% | 3.5% | 3.3% | 3.1% | 3.3% | 5.0% | (14.7%) | |||||||||||||

| Madison Park Funding XIX, Ltd. | $5,422,500 | $6,373,537 | $6,398,550 | |||||||||||||||||

| Cash-on-Cash Distribution | n/a | n/a | n/a | n/a | n/a | n/a | n/a | |||||||||||||

| Junior Overcollateralization Cushion | n/a | n/a | 3.8% | 5.6% | 6.0% | 7.2% | n/a | |||||||||||||

| Marea CLO, Ltd. | $16,217,000 | $10,618,808 | $5,647,012 | |||||||||||||||||

| Cash-on-Cash Distribution | 4.6% | 3.1% | 4.1% | 4.1% | 3.3% | (20.7%) | (29.2%) | |||||||||||||

| Junior Overcollateralization Cushion | 5.3% | 5.0% | 3.9% | 3.8% | 3.6% | (7.1%) | (32.4%) | |||||||||||||

| MidOcean Credit CLO IV | $9,500,000 | $7,398,245 | $7,030,000 | |||||||||||||||||

| Cash-on-Cash Distribution | n/a | n/a | 12.4% | 6.7% | 5.7% | (15.2%) | n/a | |||||||||||||

| Junior Overcollateralization Cushion | n/a | 4.1% | 4.1% | 4.1% | 4.1% | (1.0%) | n/a | |||||||||||||

| Mountain Hawk III CLO | $17,200,000 | $11,155,970 | $5,134,732 | |||||||||||||||||

| Cash-on-Cash Distribution | 4.9% | 4.7% | 4.8% | 4.8% | 3.1% | (35.9%) | (37.8%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.0% | 4.0% | 3.7% | 1.2% | 1.6% | 42.5% | (59.2%) | |||||||||||||

| Mountain Hawk III CLO (M Notes) | $2,389,676 | – | $356,978 | |||||||||||||||||

| Cash-on-Cash Distribution | 1.7% | 1.7% | 1.7% | 1.7% | 1.7% | (1.8%) | (0.4%) | |||||||||||||

| Junior Overcollateralization Cushion | n/a | n/a | n/a | n/a | n/a | n/a | n/a | |||||||||||||

| Neuberger Berman CLO XVI, Ltd. | $2,500,000 | $1,062,818 | $1,075,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 4.1% | 4.9% | 3.8% | 3.9% | 3.0% | (22.1%) | (25.7%) | |||||||||||||

| Junior Overcollateralization Cushion | 3.6% | 2.7% | 2.7% | 2.6% | 2.4% | (7.6%) | (33.0%) | |||||||||||||

| Newmark Capital Funding 2013- 1 CLO | $20,000,000 | $12,122,114 | $6,600,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 5.7% | 4.9% | 5.4% | 5.2% | 4.6% | (13.0%) | (19.9%) | |||||||||||||

| Junior Overcollateralization Cushion | 3.3% | 3.3% | 3.1% | 2.4% | 1.8% | (25.4%) | (46.0%) | |||||||||||||

| Shackleton 2013- III CLO, Ltd. | $5,407,500 | $3,959,337 | $2,109,450 | |||||||||||||||||

| Cash-on-Cash Distribution | 6.0% | 6.3% | 5.8% | 6.0% | 4.7% | (21.6%) | (21.7%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.6% | 4.6% | 4.1% | 3.6% | 3.3% | (9.8%) | (28.8%) | |||||||||||||

| Shackleton 2013- IV CLO, Ltd. | $21,500,000 | $15,940,844 | $8,695,962 | |||||||||||||||||

| Cash-on-Cash Distribution | 6.5% | 6.5% | 5.7% | 5.5% | 4.8% | (13.4%) | (25.8%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.4% | 4.5% | 4.1% | 3.5% | 3.3% | (6.2%) | (25.6%) | |||||||||||||

| Telos CLO 2013- 3, Ltd. | $10,416,666 | $7,681,883 | $4,687,500 | |||||||||||||||||

| Cash-on-Cash Distribution | 6.0% | 5.8% | 5.8% | 5.6% | 5.3% | (6.1%) | (12.6%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.9% | 5.0% | 5.0% | 5.0% | 4.3% | (14.0%) | (11.6%) | |||||||||||||

| Telos CLO 2013- 4, Ltd. | $11,350,000 | $7,183,572 | $5,536,204 | |||||||||||||||||

| Cash-on-Cash Distribution | 5.4% | 5.2% | 5.1% | 4.9% | 6.0% | 23.0% | 10.3% | |||||||||||||

| Junior Overcollateralization Cushion | 4.6% | 4.7% | 4.8% | 4.1% | 3.4% | (17.6%) | (26.6%) | |||||||||||||

| Telos CLO 2014- 5, Ltd. | $10,500,000 | $7,731,246 | $4,664,001 | |||||||||||||||||

| Cash-on-Cash Distribution | 6.3% | 5.8% | 5.6% | 5.6% | 5.4% | (4.3%) | (13.9%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.2% | 4.3% | 4.4% | 4.5% | 3.9% | (13.0%) | (6.0%) | |||||||||||||

| Venture XV CLO, Ltd. | $5,000,000 | $2,408,824 | $2,600,000 | |||||||||||||||||

| Cash-on-Cash Distribution | 5.3% | 6.5% | 5.2% | 5.1% | 4.5% | (12.1%) | (15.0%) | |||||||||||||

| Junior Overcollateralization Cushion | 4.0% | 3.9% | 3.6% | 2.9% | 2.5% | (12.2%) | (36.9%) | |||||||||||||

| Windriver 2012- 1 CLO, Ltd. | $7,500,000 | $5,411,574 | $4,576,096 | |||||||||||||||||

| Cash-on-Cash Distribution | 4.8% | 5.6% | 4.4% | 5.0% | 4.1% | (17.1%) | (13.6%) | |||||||||||||

| Junior Overcollateralization Cushion | 5.0% | 5.1% | 4.4% | 5.2% | 5.2% | 1.7% | 4.0% | |||||||||||||

| York CLO- 1, Ltd. | $7,000,000 | $5,167,978 | $5,250,000 | |||||||||||||||||

| Cash-on-Cash Distribution | n/a | 10.9% | 7.2% | 4.6% | 3.8% | (16.2%) | n/a | |||||||||||||

| Junior Overcollateralization Cushion | 4.8% | 4.9% | 4.4% | 4.0% | 4.5% | 12.4% | (5.6%) | |||||||||||||

| Totals / Fair Value-Weighted Average | ||||||||||||||||||||

| Balances | $400,929,771 | $273,046,485 | $197,112,697 | |||||||||||||||||

|

Cash-on-Cash Distributions22 |

6.1% | 5.7% | 5.4% | 5.2% | 4.4% | (14.4%) | (27.2%) | |||||||||||||

|

Junior Overcollateralization Cushion5 |

4.6% | 4.5% | 4.2% | 4.0% | 3.8% | (4.8%) | (17.2%) | |||||||||||||

|

Cash-on-cash distributions and junior |

||||||||||||||||||||

Appendix C: TICC CLO Equity Portfolio – Effective Yield Comparison23

| Effective Yield Comparison - Q2 2016 versus Q1 2016 | ||||||||||||||||

| At 6/30/16 | Effective Yield | |||||||||||||||

| # | Investment |

Principal ($MM) |

Cost ($MM) |

Fair Value ($MM) |

Jun-16 | Mar-16 |

Difference

(% Points) |

|||||||||

|

CLO Equity Positions Held in Both Q2 2016 and Q1 2016 |

||||||||||||||||

| 1 | AMMC CLO XI, Ltd. | $6.0 | $3.3 | $2.6 | 24.66% | 22.46% | 2.20% | |||||||||

| 2 | AMMC CLO XII, Ltd. | $12.9 | $7.9 | $6.2 | 17.75% | 13.70% | 4.05% | |||||||||

| 3 | Ares XXV CLO Ltd. | $15.5 | $10.3 | $6.8 | 4.28% | 2.88% | 1.40% | |||||||||

| 4 | Ares XXVI CLO Ltd. | $10.5 | $6.7 | $4.3 | 5.10% | 3.71% | 1.39% | |||||||||

| 5 | Ares XXIX CLO Ltd. | $12.8 | $9.4 | $6.2 | 9.13% | 5.63% | 3.50% | |||||||||

| 6 | Benefit Street Partners CLO II, Ltd. | $23.5 | $21.0 | $14.3 | 14.50% | 15.85% | (1.35%) | |||||||||

| 7 | Carlyle Global Market Strategies CLO 2013- 2, Ltd. | $10.1 | $7.0 | $5.9 | 16.78% | 22.35% | (5.57%) | |||||||||

| 8 | Carlyle Global Market Strategies CLO 2014- 4, Ltd. | $25.8 | $18.4 | $18.0 | 17.36% | 19.12% | (1.76%) | |||||||||

| 9 | Catamaran CLO 2012- 1 Ltd. | $23.0 | $13.0 | $4.1 | (14.41%) | (23.25%) | 8.84% | |||||||||

| 10 | Catamaran CLO 2013- 1 Ltd. | $14.7 | $9.6 | $7.5 | 15.41% | 8.71% | 6.70% | |||||||||

| 11 | Cedar Funding II CLO, Ltd. | $18.8 | $14.1 | $12.2 | 15.53% | 10.49% | 5.04% | |||||||||

| 12 | CIFC Funding 2012- 1, Ltd. | $12.8 | $7.3 | $4.7 | 21.53% | 11.32% | 10.21% | |||||||||

| 13 | Halcyon Loan Advisors Funding 2014- 2 Ltd. | $8.0 | $5.6 | $3.9 | 12.08% | 4.87% | 7.21% | |||||||||

| 14 | Hull Street CLO Ltd. | $5.0 | $3.6 | $2.1 | 10.51% | 5.06% | 5.45% | |||||||||

| 15 | Ivy Hill Middle Market Credit Fund VII, Ltd. | $14.0 | $11.9 | $10.2 | 16.87% | 13.79% | 3.08% | |||||||||

| 16 | Jamestown CLO V Ltd. | $8.0 | $5.5 | $2.9 | 7.70% | 4.02% | 3.68% | |||||||||

| 17 | Marea CLO, Ltd. | $16.2 | $10.6 | $5.6 | (0.36%) | (6.72%) | 6.36% | |||||||||

| 18 | MidOcean Credit CLO IV | $9.5 | $7.4 | $7.0 | 19.69% | 20.01% | (0.32%) | |||||||||

| 19 | Mountain Hawk III CLO, Ltd. | $17.2 | $11.2 | $5.1 | (2.13%) | 2.74% | (4.87%) | |||||||||

| 20 | Newmark Capital Funding 2013-1 CLO Ltd. | $20.0 | $12.1 | $6.6 | 2.08% | 2.96% | (0.88%) | |||||||||

| 21 | Shackleton 2013- III CLO, Ltd. | $5.4 | $4.0 | $2.1 | 2.03% | 1.93% | 0.10% | |||||||||

| 22 | Shackleton 2013- IV CLO, Ltd. | $21.5 | $15.9 | $8.7 | 5.41% | 6.50% | (1.09%) | |||||||||

| 23 | Telos CLO 2013- 3, Ltd. | $10.4 | $7.7 | $4.7 | 18.03% | 13.85% | 4.18% | |||||||||

| 24 | Telos CLO 2013- 4, Ltd. | $11.4 | $7.2 | $5.5 | 28.93% | 22.82% | 6.11% | |||||||||

| 25 | Telos CLO 2014- 5, Ltd. | $10.5 | $7.7 | $4.7 | 19.46% | 16.32% | 3.14% | |||||||||

| 26 | Windriver 2012- 1 CLO, Ltd. | $7.5 | $5.4 | $4.6 | 22.46% | 20.86% | 1.60% | |||||||||

| Total / Cost-Weighted Average | $350.8 | $243.8 | $166.6 | 10.9% | 8.8% | |||||||||||

|

TICC increased the |

||||||||||||||||

|

CLO Equity Positions Added in Q2 2016 |

||||||||||||||||

| 27 | ACAS CLO 2012- 1, Ltd. | $6.0 | $2.2 | $2.5 | 58.76% | |||||||||||

| 28 | ALM X, Ltd. | $3.8 | $2.6 | $2.6 | 21.78% | |||||||||||

| 29 | ALM XII, Ltd. | $2.8 | $2.5 | $2.4 | 18.99% | |||||||||||

| 30 | FINN Square CLO, Ltd. | $5.5 | $2.2 | $2.3 | 26.31% | |||||||||||

| 31 | GoldenTree Loan Opportunities VII, Ltd. | $4.7 | $3.0 | $3.1 | 19.81% | |||||||||||

| 32 | KVK CLO 2013- 2, Ltd. | $5.0 | $1.8 | $2.0 | 43.57% | |||||||||||

| 33 | Madison Park Funding XIX, Ltd. | $5.4 | $6.4 | $6.4 | 15.80% | |||||||||||

| 34 | Neuberger Berman CLO XVI, Ltd. | $2.5 | $1.1 | $1.1 | 31.82% | |||||||||||

| 35 | Venture XV CLO, Ltd. | $5.0 | $2.4 | $2.6 | 28.63% | |||||||||||

| 36 | York CLO- 1, Ltd. | $7.0 | $5.2 | $5.3 | 18.01% | |||||||||||

| Total / Cost-Weighted Average | $47.7 | $29.3 | $30.2 | 24.8% | ||||||||||||

| Total / Cost-Weighted Average | $398.5 | $273.0 | $196.8 | 12.4% | ||||||||||||

Appendix D: TICC Long-Term Underperformance

See multimedia carousel for chart.

| TICC Relative Performance | ||||||||||||||||||||

|

Total Return (%)24 |

YTD | 1Y | 3Y |

Since |

Since IPO |

YTD | 1Y | 3Y | Since IPO22 |

Since IPO |

||||||||||

| TICC | 14.7% | 15.7% | 1.7% | 76.8% | 4.6% | - | - | - | - | |||||||||||

|

BDC Composite 26 |

17.5 | 16.9 | 12.2 | 259.7 | 10.6 | (2.9)% | (1.2)% | (10.5)% | (182.9)% | (6.0)% | ||||||||||

| S&P 500 | 8.6 | 13.4 | 40.0 | 175.0 | 8.2 | 6.1% | 2.3 % | (38.4)% | (98.3)% | (3.7)% | ||||||||||

| U.S. Treasuries | 5.8 | 4.8 | 13.6 | 70.2 | 4.3 | 8.8% | 10.9 % | (12.0)% | 6.6% | 0.3% | ||||||||||

| Investment Grade Debt | 11.4 | 10.9 | 24.3 | 106.1 | 5.8 | 3.3% | 4.8 % | (22.6)% | (29.4)% | (1.3)% | ||||||||||

| High Yield Debt | 13.1 | 8.3 | 15.1 | 120.8 | 6.4 | 1.6% | 7.4 % | (13.4)% | (44.0)% | (1.8)% | ||||||||||

|

Note: Market data as of August 23, 2016 |

||||||

|

Source: Bloomberg, fixed income benchmark data from Markit iBoxx |

||||||

Appendix E: TICC Historical Performance

See multimedia carousel for chart.

| Period Beginning November 21st | ||||||||||||||||||||||||

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||

| TICC Total Return Greater than BDC Composite | ||||||||||||||||||||||||

|

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||||||||||

| To date, TICC has underperformed the BDC Composite in 85% of the periods with start dates beginning each year since IPO. The Board and management are cherry-picking the best performance window (since 2008) to justify their “long-term” performance. | ||

|

(1) |

Total return calculation includes share price appreciation and cumulative dividends paid. |

|||||||

|

(2) |

BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC, GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD |

|||||||

|

Note: Market data as of August 23, 2016 |

||||||||

|

Source: Bloomberg |

||||||||

About

Forward-Looking Statements

Information set forth herein may contain forward-looking statements,

including, but not limited to, statements with regard to the expected

future financial position, results of operations, cash flows, dividends,

portfolio, financing plans, business strategy, budgets, capital

expenditures, competitive positions, growth opportunities, plans and

objectives of management of

Such forward-looking statements are inherently uncertain, and

stockholders and other potential investors must recognize that actual

results may differ materially from TSLX’s expectations as a result of a

variety of factors including, without limitation, those discussed below.

Such forward-looking statements are based upon TSLX’s current

expectations and include known and unknown risks, uncertainties and

other factors, many of which TSLX is unable to predict or control, that

may cause TSLX’s plans with respect to TICC or the actual results or

performance of TICC, TSLX or TICC and TSLX on a combined basis to differ

materially from any plans, future results or performance expressed or

implied by such forward-looking statements. These statements involve

risks, uncertainties and other factors discussed below and detailed from

time to time in TSLX’s filings with the

Risks and uncertainties related to a possible transaction include, among others, uncertainty as to whether TSLX will further pursue, enter into or consummate a transaction on the terms set forth in its proposal or on other terms, uncertainty as to whether TICC’s board of directors will engage in good faith, substantive discussions or negotiations with TSLX concerning its proposal or any other possible transaction, potential adverse reactions or changes to business relationships resulting from the announcement or completion of a transaction, uncertainties as to the timing of a transaction, adverse effects on TSLX’s stock price resulting from the announcement or consummation of a transaction or any failure to complete a transaction, competitive responses to the announcement or consummation of a transaction, the risk that regulatory or other approvals and any financing required in connection with the consummation of a transaction are not obtained or are obtained subject to terms and conditions that are not anticipated, costs and difficulties related to a potential integration of TICC’s businesses and operations with TSLX’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from a transaction, unexpected costs, liabilities, charges or expenses resulting from a transaction, litigation relating to a transaction, the inability to retain key personnel, and any changes in general economic and/or industry specific conditions.

In addition to these factors, other factors that may affect TSLX’s plans, results or stock price are set forth in TSLX’s Annual Report on Form 10-K and in its reports on Forms 10-Q and 8-K.

Many of these factors are beyond TSLX’s control. TSLX cautions investors that any forward-looking statements made by TSLX are not guarantees of future performance. TSLX disclaims any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-looking statements to reflect future events or developments.

Third Party-Sourced Statements and Information

Certain statements and information included herein have been sourced from third parties. TSLX does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein. All information in this communication regarding TICC, including its businesses, operations and financial results, was obtained from public sources. While TSLX has no knowledge that any such information is inaccurate or incomplete, TSLX has not verified any of that information. TSLX reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. TSLX disclaims any obligation to update the data, information or opinions contained herein.

Proxy Solicitation Information

In connection with TSLX’s solicitation of proxies for the 2016 annual

meeting of TICC stockholders in favor of (a) the election of TSLX’s

nominee to serve as a director of TICC and (b) TSLX’s proposal to

terminate the Investment Advisory Agreement, dated as of

TSLX STRONGLY ADVISES ALL STOCKHOLDERS OF TICC TO READ THE TSLX PROXY STATEMENT AND THE OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION. SUCH TSLX PROXY MATERIALS ARE AND WILL BECOME AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV AND ON TSLX’S WEBSITE AT HTTP://WWW.TPGSPECIALTYLENDING.COM. IN ADDITION, TSLX WILL PROVIDE COPIES OF THE TSLX PROXY STATEMENT WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO TSLX’S PROXY SOLICITOR AT TPG@MACKENZIEPARTNERS.COM.

The participants in the solicitation are TSLX and

Security holders may obtain information regarding the names,

affiliations and interests of TSLX’s directors and executive officers in

TSLX’s Annual Report on Form 10-K for the year ended

This document shall not constitute an offer to sell, buy or exchange or the solicitation of an offer to sell, buy or exchange any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

1 See Appendix A for further detail

2 Source: TICC Investor Presentation for the quarter ended

3 See Appendix C for further detail

4 See Appendix A for further detail

5 Source:

6 Source:

7 Source:

8 Source:

9 Source:

10 Source:

11 See Appendix A for further detail

12 BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC,

GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD Note:

Market data as of

13 Source: Net asset value per share has declined from

14 See Appendix E for further detail

15 Source:

16 Source: Intex Solutions

17 Excludes Windriver 2012-1

18 As of

19 Calculated as the quotient of (i) the amount distributed to the equity tranche in each respective quarter, divided by (ii) the original balance of the equity tranche

20 Calculated as the quotient of (i) the difference between the actual overcollateralization value and the limit overcollateralization value, divided by (ii) the limit overcollateralization value

21 As of

22 Excludes investments for which there were no distributions and/or there was no overcollateralization tests in each respective period

23 Source:

24 Total return calculation includes share price appreciation and cumulative dividends paid

25 TICC and benchmark returns indexed to

26 BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC, GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD

View source version on businesswire.com: http://www.businesswire.com/news/home/20160829005496/en/

Source:

Investors

TPG Specialty Lending, Inc.

Lucy Lu, 212-601-4753

llu@tpg.com

or

MacKenzie

Partners, Inc.

Charlie Koons, 800-322-2885

tpg@mackenziepartners.com

or

Media

TPG

Specialty Lending, Inc.

Luke Barrett, 212-601-4752

lbarrett@tpg.com

or

Abernathy

MacGregor

Tom Johnson or Pat Tucker

212-371-5999

tbj@abmac.com

/ pct@abmac.com